The Kindness of Banks

By Barb Weir

By Barb Weir

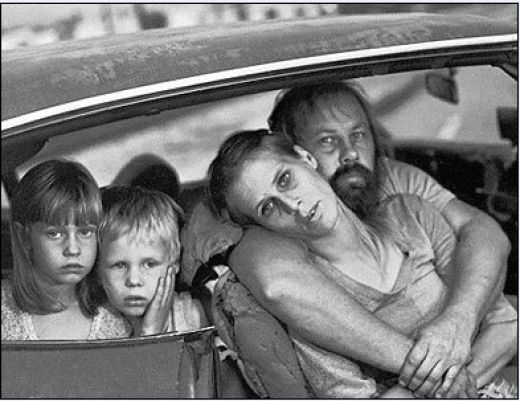

Penin Diaz, an American friend of mine, sent me this distressing report that I felt I had to share. Some of the details are uniquely American, but the experience is not – Barb Weir

Our family is going through hard times, and we’re trying to cut expenses, so I asked my bank about mortgage loan modification.

“We’re here to help you, Mr. Diaz,” said the loan officer. “How far behind are you in your mortgage payments? You don’t qualify unless you’re pretty destitute.”

“We’re not behind yet,” I said, “but I lost my job. In order to keep up the payments, we had to shut down the heating and air conditioning and eat peanut butter sandwiches. My son is wearing my daughter’s hand-me-downs, which she got at the thrift store. My wife sold all her jewelry, and is getting additional income from what she calls ‘the kindness of strangers.’”

“That’s terrible, Mr. Diaz, but I can’t help unless your payments are at least two months behind. Stop paying and come back in two months.”

So we did and I returned after two months.

“Good job,” said the loan officer. “Fill out these forms, and mail them in, along with proof of how poor you now are, compared to when you took out the loan.”

“Should I make another mortgage payment so that we don’t fall farther behind? My wife is pretty good at making friends with strangers.”

“Absolutely not! That would jeopardize your chances for loan modification.”

So I sent the application and documents. After another two months, I called to check.

“The backlog is really huge,” he reported, “but they promised to look at your case next month.”

“Should I make another mortgage payment? I’m concerned about falling so far behind.”

“Please trust us,” he replied. “If you can’t trust a bank, who can you trust? Under no circumstances should you make a payment.”

Finally, the loan officer called to say the application had been processed. “But there’s a problem,” he said. “It seems that you still have three dollars of equity in your house. Although your house has dropped a lot in value, I’m afraid you’re still not poor enough to qualify for modification.”

“What can we do?”

“You have to make all the delinquent payments now or we foreclose, and in fact we began foreclosure proceedings a couple of months ago, just in case this might happen.”

“But you advised us to stop making payments.”

“I was only doing my best to help you qualify for modification, but since you don’t, there’s nothing more I can do.”

“But isn’t foreclosure bad business for you? The housing market is terrible, so you’ll never recover the amount of the mortgage.”

“It’s kind of you to think of us, but we already got most of our investment from insurance as soon as you fell two months behind. Now we can now sell the house for peanuts and still make a bundle.”

“If you’re going to sell it for peanuts, I’m willing to buy. We can definitely afford payments on a cheaper house.”

“I’m sorry, but you don’t qualify. You haven’t paid your mortgage for six months now, so your credit is terrible. I wish I could help, but this is your own doing.”

The story has a happy ending. I trashed my house, broke the windows, sprayed graffiti everywhere, borrowed weeds from another foreclosed house down the street and got a lower appraisal that qualified me for modification. The neighbors are envious, but asked me not to fix my house for fear that it will raise values and make it impossible for them to qualify for loan modification.

&n bsp; Penin Diaz